Testing

Modern

Business Banking

Millions of businesses of all sizes trust Instantpay’s full-featured current account & debit card that combines payments, collections, expense management, and banking APIs to manage their businesses efficiently.

Trusted by leading businesses in India

Smart Current Account

Next-gen banking account to help your business grow. Manage payouts, collections, expenses, and more in real time.

Smart Current Account

Next-gen banking account to help your business grow. Manage payouts, collections, expenses, and more in real time.

Payouts Made Simple

Pay vendors, customers, and employees instantly through all payment methods – bank accounts, UPI, cards & wallets.

Get Paid on Time

Collect, track & manage payments seamlessly with easy reconciliation and real-time settlement of funds.

Manage Expenses

The easiest way to spend, track, and manage expenses. We have a full suite of corporate cards designed for you.

Working Capital

Meet your evolving business needs with Instantpay’s business-friendly offerings that are easily accessible online through us.

Get Ahead With The New Era of Banking

Insights

Real-time reporting

Visual Workflows

Automation and workflows

Insights

Real-time reporting

Integration

Connect third party Apps

Accessibility

via App, web, or API

Create price quotes in minutes

Dashboard

Single source of truth

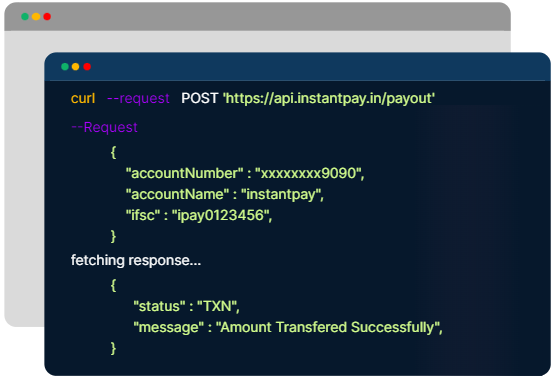

Modern API banking stack that is easy to understand, implement, and iterate. Designed with reliability and scalability in mind.

Features

Powerful APIs

Integrate banking into your application with our bundle of flexible APIs used by thousands of large businesses.

Clear Documentation

Get started quickly with clear docs, code samples and SDKs to guide you throughout the implementation.

Elastic Platform

Super scalable cloud platform that auto-scales from zero to a million transactions, all in a single day.

Dedicated Support

Meet your strict go-live schedules with our fast, helpful implementation support via phone, chat or email.

Sandbox Mode

Play around and safely validate your code with a sandbox mode before hitting the production environment.

Secure API

Several verification levels to maximise the security of requests between our API and your infrastructure.

Plan That Suits You

Small & Medium Business

Unified dashboard to manage all your business banking needs. Access multiple bank accounts, check balances, make transfers, accept online payments, and more.

Enterprise

Banking automation that streamlines your business process. Make bulk payouts, refund customers, and verify accounts in a flash using tailor-made APIs.

Built with Security in Mind

Transact securely with data encryption using 256-bit SSL, which is one of the most secure encryption methods ensuring privacy, authentication & integrity.

In accordance with strict security standards, we protect the confidentiality of data, and do not disclose any sensitive information.

Ready to get started?

Get in touch or signup in less than a minute to experience a fast, flexible & transparent way to bank.

Download the Instantpay app!

Add Your Heading Text Here

Add Your Heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.